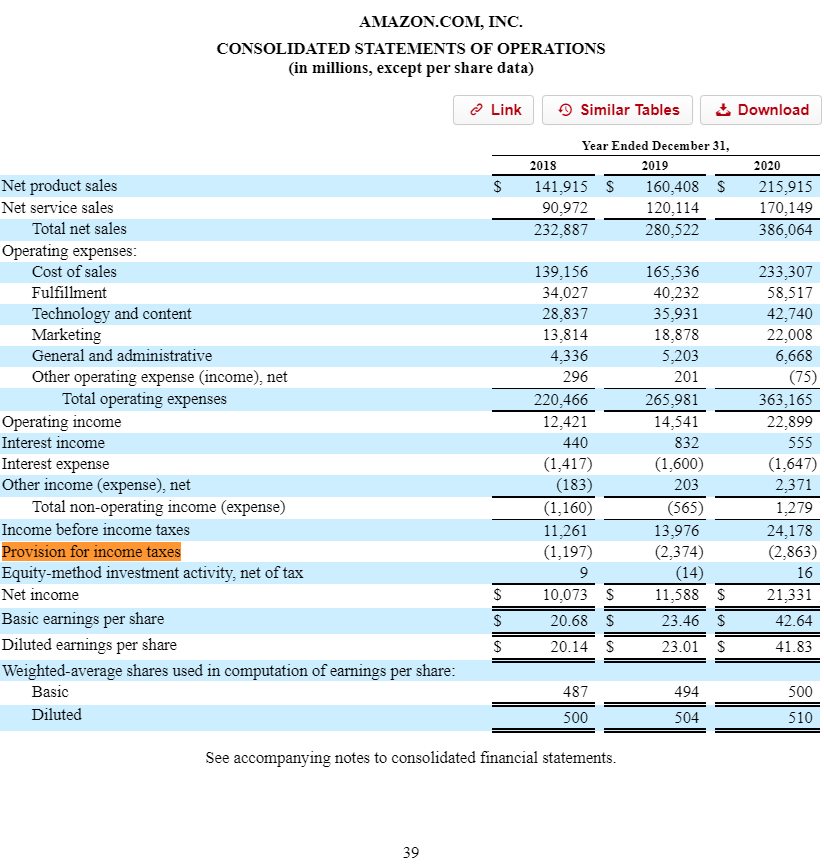

What is the difference between provision for income tax and provision for deferred tax in tax expense - General - Trading Q&A by Zerodha - All your queries on trading and markets answered

Operating profit after provision for tax is 628000 r•rom Net Cash Operating Profit after Provision for Tax o' RsA %' - Accountancy - Cash Flow Statement - 13462499 | Meritnation.com